Essay

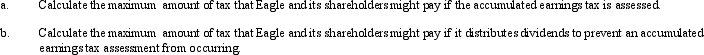

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $600,000 in 2012.Assume that its shareholders are in the 35% marginal tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Section 1244 ordinary loss treatment is available

Q38: To the extent of built-in gain or

Q45: For a C corporation to be classified

Q53: A C corporation offers greater flexibility in

Q79: The check-the-box Regulations have made it easier

Q81: Colin and Reed formed a business entity

Q82: To which of the following entities does

Q85: Albert and Elva each own 50% of

Q89: Kirby,the sole shareholder of Falcon,Inc. ,leases a

Q99: What is the major pitfall associated with