Multiple Choice

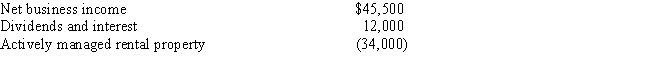

Karl has the following income (loss) during the current year:

What is Karl's adjusted gross income for this year?

A) $23,500

B) $31,400

C) $32,500

D) $45,500

E) $57,500

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Georgia sells stock she purchased for $20,000

Q3: Gomez, a self-employed consultant, is involved in

Q10: Judy and Larry are married and their

Q31: Which of the following losses are generally

Q40: Nancy is the owner of an apartment

Q54: The term tax shelter refers to investment

Q85: Nelson is the owner of an apartment

Q87: Pedro owns a 50% interest in a

Q111: For each of the following situations, determine

Q140: Match each of the following statements with