Short Answer

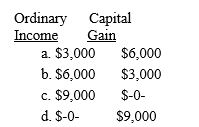

On October 2,2016,Miriam sells 1,000 shares of stock at $20 per share.Miriam acquired the stock on November 12,2015,when she exercised her option to purchase the shares through her company's incentive stock option plan.The exercise price was $11 per share and the fair market value of the stock at the date of exercise was $14 per share.For 2016,Miriam must report

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Dunn Company bought an old building in

Q16: For the current year, Salvador's regular tax

Q30: Which of the following is (are)AMT tax

Q37: Cary is an employee with the Bayview

Q40: Jane is a partner with Smithstone LLP.

Q47: Unmarried taxpayers who are not active participants

Q48: When calculating AMTI, individual taxpayers must add

Q91: Karl is scheduled to receive an annuity

Q94: Karen receives the right to acquire 400

Q95: Tim has a 25% interest in Hill