Essay

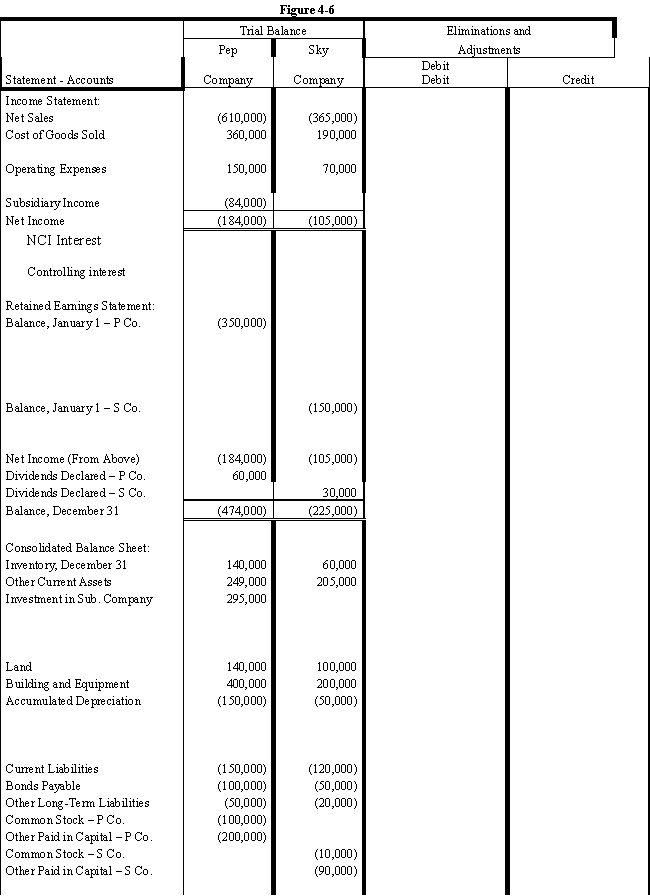

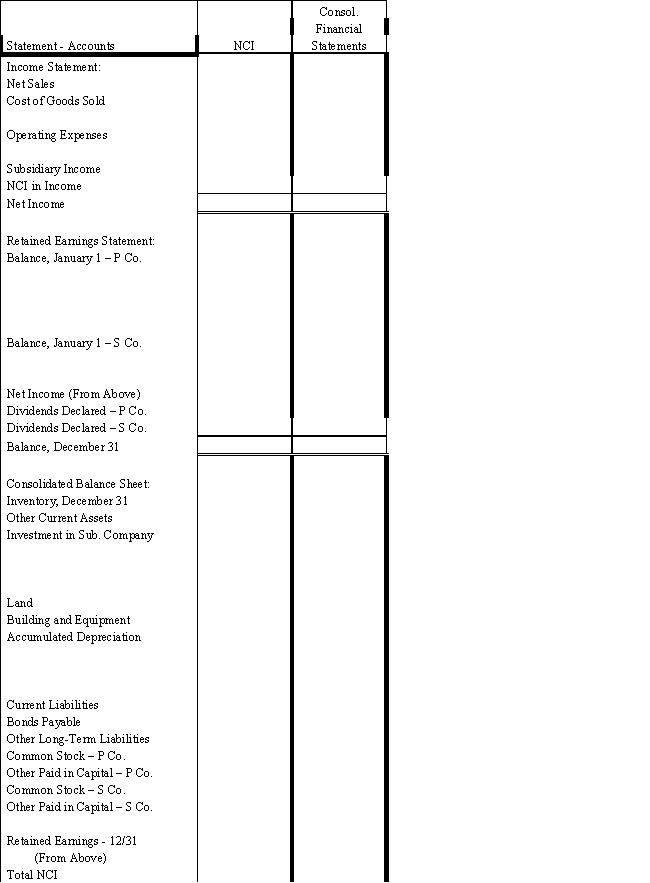

On January 1, 2016, Pep Company acquired 80% of the common stock of Sky Company for $195,000.On this date Sky had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earnings of $10,000, $90,000, and $100,000 respectively).

?

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents.FIFO is used for inventories.The equipment has a remaining life of five years and straight-line depreciation is used.The excess attributable to the patents is to be amortized over 20 years.

?

During 2016 and 2017, Pep has appropriately accounted for its investment in Sky using the simple equity method.

?

On January 1, 2017, Pep held merchandise acquired from Sky for $10,000.During 2017, Sky sold merchandise to Pep for $50,000, $20,000 of which is still held by Pep on December 31, 2017.Sky's usual gross profit on affiliated sales is 50%.

?

On December 31, 2016, Pep sold equipment to Sky at a gain of $10,000.During 2017, the equipment was used by Sky.Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

?

Required:

?

a.Using the information above or on the Figure 4-6 worksheet, prepare a determination and distribution of excess schedule.?

?

b.Complete the Figure 4-6 worksheet for consolidated financial statements for the year ended December 31, 2017.?

?

?

?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: If subsidiary net income is $15,000 for

Q3: Which of the following should appear in

Q4: Pease Corporation owns 100% of Sade

Q5: Porch Company owns a 90% interest

Q6: On January 1, 2016, Prange Company acquired

Q7: Power Company owns a 70% controlling

Q8: Stroud Corporation is an 80%-owned subsidiary of

Q9: Sally Corporation, an 80%-owned subsidiary of Reynolds

Q10: Selected information from the separate and

Q11: On January 1, 2016, Powers Company acquired