Short Answer

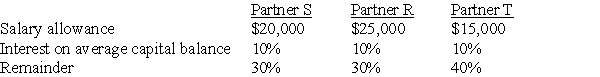

The SRT partnership agreement specifies that partnership net income be allocated as follows:

Average capital balances for the current year were $60,000 for S, $50,000 for R, and $40,000 for T.

Average capital balances for the current year were $60,000 for S, $50,000 for R, and $40,000 for T.

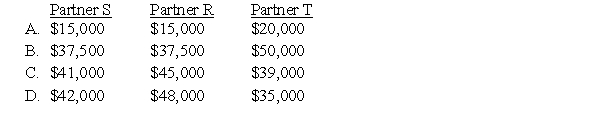

-Refer to the information given.Assuming a current year net income of $125,000,what amount should be allocated to each partner?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: When a partner retires from a partnership

Q34: James Dixon,a partner in an accounting firm,decided

Q36: Griffin and Rhodes formed a partnership on

Q37: Fox,Greg,and Howe are partners with average capital

Q42: Miller and Davis,partners in a consulting business,share

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q43: In the AD partnership, Allen's capital is

Q44: Jones and Smith formed a partnership with

Q46: In the RST partnership,Ron's capital is $80,000,Stella's

Q50: The partnership of X and Y shares