Multiple Choice

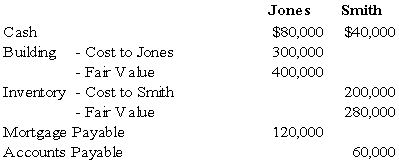

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

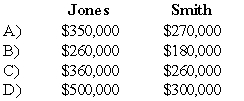

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q17: When the old partners receive a bonus

Q39: The SRT partnership agreement specifies that partnership

Q42: Miller and Davis,partners in a consulting business,share

Q43: In the AD partnership, Allen's capital is

Q45: In the JK partnership, Jacob's capital is

Q46: In the RST partnership,Ron's capital is $80,000,Stella's

Q49: On June 30,the balance sheet for the

Q50: The partnership of X and Y shares

Q52: The ABC partnership had net income of