Multiple Choice

In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following questions is independent of the others.

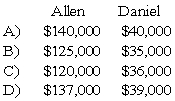

-Refer to the information provided above.Allen and Daniel agree that some of the inventory is obsolete.The inventory account is decreased before David is admitted.David invests $40,000 for a one-fifth interest.What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q8: When a partner retires from a partnership

Q17: When the old partners receive a bonus

Q39: The SRT partnership agreement specifies that partnership

Q42: Miller and Davis,partners in a consulting business,share

Q44: Jones and Smith formed a partnership with

Q45: In the JK partnership, Jacob's capital is

Q46: In the RST partnership,Ron's capital is $80,000,Stella's

Q50: The partnership of X and Y shares

Q52: The ABC partnership had net income of