Multiple Choice

Use the following information to answer the question(s) below..

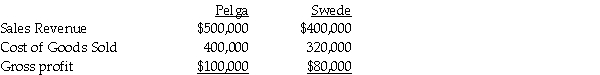

Pelga Company routinely receives goods from its 80%-owned subsidiary,Swede Corporation.In 2011,Swede sold merchandise that cost $80,000 to Pelga for $100,000.Half of this merchandise remained in Pelga's December 31,2011 inventory.This inventory was sold in 2012.During 2012,Swede sold merchandise that cost $160,000 to Pelga for $200,000.$62,500 of the 2012 merchandise inventory remained in Pelga's December 31,2012 inventory.Selected income statement information for the two affiliates for the year 2012 was as follows:

-Consolidated cost of goods sold for Pelga and Subsidiary for 2012 were

A) $512,000.

B) $526,000.

C) $522,500.

D) $528,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Phast Corporation owns a 80% interest in

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q20: Use the following information to answer the

Q20: The material sale of inventory items by

Q21: Perry Instruments International purchased 75% of the

Q23: Pfeifer Corporation acquired an 80% interest in

Q25: Use the following information to answer the

Q26: Use the following information to answer the

Q27: Use the following information to answer the