Essay

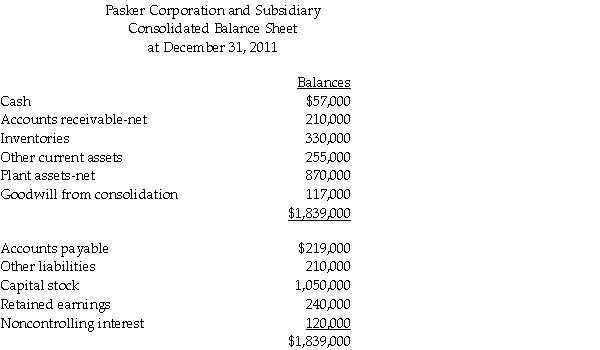

The consolidated balance sheet of Pasker Corporation and Shishobee Farm, its 80% owned subsidiary, as of December 31, 2011, contains the following accounts and balances:

Pasker Corporation acquired its interest in Shishobee Farm on January 1, 2011, when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Pasker Corporation acquired its interest in Shishobee Farm on January 1, 2011, when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Required: Determine the following amounts:

1.The balance of Pasker's Capital Stock and Retained Earnings accounts at December 31, 2011.

2.Cost of Pasker's purchase of Shishobee Farm on January 1, 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1, 2011, Parry Incorporated paid

Q5: On June 1,2011,Puell Company acquired 100% of

Q6: On January 1, 2005, Myna Corporation issued

Q7: On January 1, 2011, Pinnead Incorporated paid

Q9: Pamula Corporation paid $279,000 for 90% of

Q16: A newly acquired subsidiary had pre-existing goodwill

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q29: Pental Corporation bought 90% of Sedacor Company's

Q35: Pomograte Corporation bought 75% of Sycamore Company's