Multiple Choice

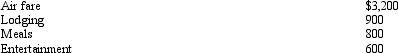

During the year,Walt went from Louisville to Hawaii on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

A) $5,500.

B) $4,800.

C) $3,900.

D) $3,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: In the case of an office in

Q45: One of the tax advantages of being

Q46: Once the actual cost method is used,

Q47: Once set for a year, when might

Q107: If a business retains someone to provide

Q108: Travel status requires that the taxpayer be

Q110: Ava holds two jobs and attends graduate

Q111: During the year,Peggy went from Nashville to

Q113: A moving expense deduction is allowed even

Q153: An education expense deduction is not allowed