Essay

Travel status requires that the taxpayer be away from home overnight.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: In the case of an office in

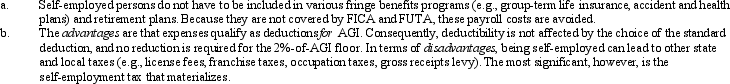

Q45: One of the tax advantages of being

Q47: Once set for a year, when might

Q107: If a business retains someone to provide

Q109: During the year,Walt went from Louisville to

Q110: Ava holds two jobs and attends graduate

Q111: During the year,Peggy went from Nashville to

Q113: A moving expense deduction is allowed even

Q134: A taxpayer who claims the standard deduction

Q153: An education expense deduction is not allowed