Essay

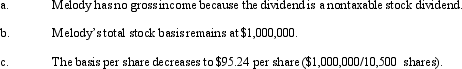

Inez's adjusted basis for 9,000 shares of Cardinal,Inc.common stock is $900,000.During the year,she receives a 5% stock dividend that is a nontaxable stock dividend.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q59: Sam and Cheryl,husband and wife,own property jointly.The

Q59: The adjusted basis for a taxable bond

Q60: Ed and Cheryl have been married for

Q61: Expenditures made for ordinary repairs and maintenance

Q63: On September 18,2012,Jerry received land and a

Q65: If the alternate valuation date is elected

Q82: Alvin is employed by an automobile dealership

Q83: Stuart owns land with an adjusted basis

Q92: On the sale of property between related

Q138: Which of the following statements is correct?<br>A)Under