Essay

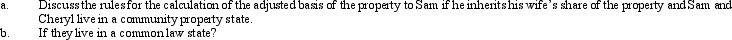

Sam and Cheryl,husband and wife,own property jointly.The property has an adjusted basis of $400,000 and a fair market value of $500,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Annette purchased stock on March 1, 2012,

Q11: Rob was given a residence in 2012.At

Q11: Realized gain or loss is measured by

Q60: Ed and Cheryl have been married for

Q63: On September 18,2012,Jerry received land and a

Q64: Inez's adjusted basis for 9,000 shares of

Q92: On the sale of property between related

Q138: Which of the following statements is correct?<br>A)Under

Q248: If property that has been converted from

Q281: Gift property (disregarding any adjustment for gift