Essay

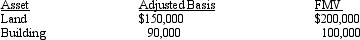

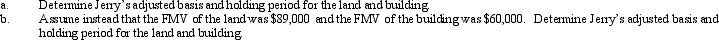

On September 18,2012,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2009,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Correct Answer:

Verified

The basis is allocated to the land and ...

The basis is allocated to the land and ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Annette purchased stock on March 1, 2012,

Q59: Sam and Cheryl,husband and wife,own property jointly.The

Q59: The adjusted basis for a taxable bond

Q60: Ed and Cheryl have been married for

Q61: Expenditures made for ordinary repairs and maintenance

Q64: Inez's adjusted basis for 9,000 shares of

Q82: Alvin is employed by an automobile dealership

Q83: Stuart owns land with an adjusted basis

Q92: On the sale of property between related

Q138: Which of the following statements is correct?<br>A)Under