REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

Multiple Choice

REFERENCE: Ref.09_04

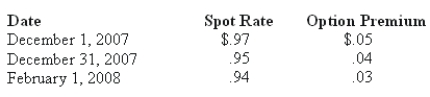

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Compute the value of the foreign currency option at December 1,2007.

A) $6,000.

B) $4,500.

C) $3,000.

D) $7,500.

E) $1,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Primo Inc., a U.S. company, ordered parts

Q13: Where can you find exchange rates between

Q23: What amount of foreign exchange gain or

Q23: What happens when a U.S. company purchases

Q60: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q67: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q68: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q69: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q83: What is the major assumption underlying the

Q92: How much Foreign Exchange Gain or Loss