REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

Multiple Choice

REFERENCE: Ref.09_04

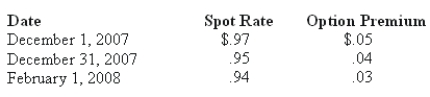

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Alpha,Inc. ,a U.S.company,had a receivable from a customer that was denominated in pesos.On December 31,2008,this receivable for 75,000 pesos was correctly included in Alpha's balance sheet at $8,000.The receivable was collected on March 2,2009,when the U.S.equivalent was $6,900.How much foreign exchange gain or loss will Alpha record on the income statement for the year ended December 31,2009?

A) $1,100 loss.

B) $1,100 gain.

C) $6,900 loss.

D) $6,900 gain.

E) $8,000 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Primo Inc., a U.S. company, ordered parts

Q65: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q67: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q68: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q71: REFERENCE: Ref.09_11<br>Coyote Corp.(a U.S.company in Texas)had the

Q72: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q73: REFERENCE: Ref.09_02<br>Brisco Bricks purchases raw material from

Q74: Old Colonial Corp.(a U.S.company)made a sale to

Q83: What is the major assumption underlying the

Q92: How much Foreign Exchange Gain or Loss