REFERENCE: Ref.09_07 Winston Corp. ,A U.S.company,had the Following Foreign Currency Transactions During

Multiple Choice

REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following foreign currency transactions during 2008:

(1. ) Purchased merchandise from a foreign supplier on July 16,2008 for the U.S.dollar equivalent of $47,000 and paid the invoice on August 3,2008 at the U.S.dollar equivalent of $54,000.

(2. ) On October 15,2008 borrowed the U.S.dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15,2008.The U.S.dollar equivalent of the note amount was $295,000 on December 31,2008,and $299,000 on October 15,2009.

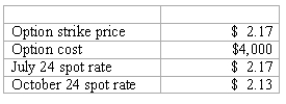

-Woolsey Corporation,a U.S.company,expects to order goods from a British supplier at a price of 250,000 pounds,with delivery and payment to be made on October 24.On July 24,Woolsey purchased a three-month call option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction.The following exchange rates apply:

What amount will Woolsey include as an option expense in net income during the period July 24 to October 24?

A) $4,000.

B) $5,000.

C) $10,000.

D) $12,000.

E) $14,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Primo Inc., a U.S. company, ordered parts

Q23: What amount of foreign exchange gain or

Q23: What happens when a U.S. company purchases

Q65: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q68: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q69: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q71: REFERENCE: Ref.09_11<br>Coyote Corp.(a U.S.company in Texas)had the

Q72: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q83: What is the major assumption underlying the

Q92: How much Foreign Exchange Gain or Loss