Essay

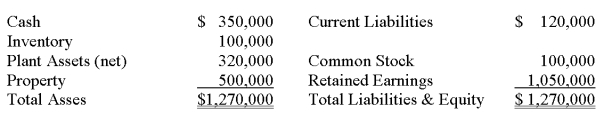

Parent Company acquired 90% of Son Inc.on January 31,20X2 in exchange for cash.The book value of Son's individual assets and liabilities approximated their acquisition-date fair values.On the date of acquisition,Son reported the following:

During the year Son Inc.reported $310,000 in net income and declared $15,000 in dividends.Parent Company reported $520,000 in net income and declared $25,000 in dividends.Parent accounts for their investment using the equity method.

Required:

1)What journal entry will Parent make on the date of acquisition to record the investment in Son Inc?

2)If Parent were to prepare a consolidated balance sheet on the acquisition date (January 31,20X2),what is the basic elimination entry Parent would use in the consolidation worksheet?

3)What is Parent's balance in "Investment in Son Inc." prior to consolidation on December 31,20X2?

4)What is the basic elimination entry Parent would use in the consolidation worksheet on December 31,20X2?

Correct Answer:

Verified

1)

2)

3)$1,300,500

(...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2)

3)$1,300,500

(...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: On January 3,20X9,Pleat Company acquired 80 percent

Q26: On January 1,20X8,Potter Corporation acquired 90 percent

Q29: On January 1,20X8,Gregory Corporation acquired 90 percent

Q31: On January 1,20X8,Gregory Corporation acquired 90 percent

Q31: Small-Town Retail owns 70 percent of Supplier

Q33: On January 3, 20X9, Jane Company acquired

Q37: Under FASB 141R,consolidation follows largely which theory

Q38: On December 31,20X9,Rudd Company acquired 80 percent

Q38: When a primary beneficiary's consolidation of a

Q49: Small-Town Retail owns 70 percent of Supplier