Essay

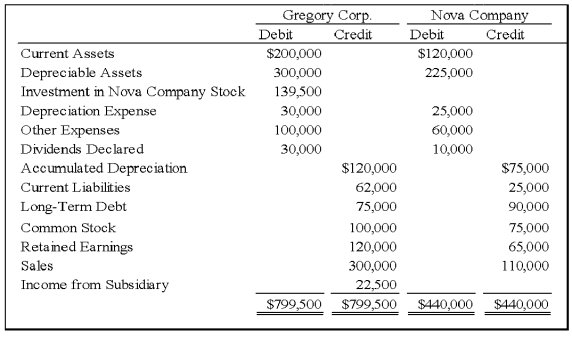

On January 1,20X8,Gregory Corporation acquired 90 percent of Nova Company's voting stock,at underlying book value.The fair value of the noncontrolling interest was equal to 10 percent of the book value of Nova at that date.Gregory uses the equity method in accounting for its ownership of Nova.On December 31,20X8,the trial balances of the two companies are as follows:

Required:

1)Provide all eliminating entries required as of December 31,20X8,to prepare consolidated financial statements.

2)Prepare a three-part consolidation worksheet.

Correct Answer:

Verified

1)

(T-Acco...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(T-Acco...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: On January 3,20X9,Pleat Company acquired 80 percent

Q7: On January 3, 20X9, Jane Company acquired

Q25: On January 1,20X8,Potter Corporation acquired 90 percent

Q27: Blue Company owns 80 percent of the

Q29: On January 1,20X8,Gregory Corporation acquired 90 percent

Q31: Small-Town Retail owns 70 percent of Supplier

Q33: On January 3, 20X9, Jane Company acquired

Q34: Parent Company acquired 90% of Son Inc.on

Q38: On December 31,20X9,Rudd Company acquired 80 percent

Q49: Small-Town Retail owns 70 percent of Supplier