Essay

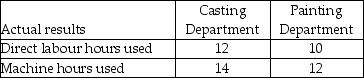

The Braveheart Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: cutting and painting. The Cutting Department uses a departmental overhead rate of $12 per machine hour, while the Painting Department uses a departmental overhead rate of $17 per direct labour hour. Job 422 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $20 per direct labour hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Braveheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

Correct Answer:

Verified

Q67: The movement of parts is considered a

Q68: Use the information below to answer the

Q70: Use the information below to answer the

Q71: In ABC it is assumed that it

Q74: Use the information below to answer the

Q75: Clucker Chicken produces several styles of precooked

Q76: Why are the benefits of adopting ABC/ABM

Q77: If a company's plantwide overhead rate is

Q83: If a company uses departmental overhead allocation

Q108: Managers often reap benefits by using ABC