Essay

Clucker Chicken produces several styles of precooked and package chicken wings (drums,

tips, buffalo and coated with a variety of spices and sauces). Each style of wing requires different

preparation time, different cooking and draining times and different packaging. Therefore

the company management has decided to try ABC costing to better capture the manufacturing

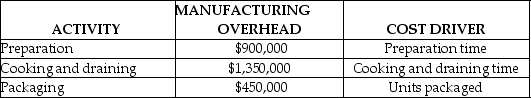

overhead costs incurred by each style of wing. The following activities related to yearly

manufacturing overhead costs and cost drivers have been identified:

Compute the activity cost allocation rates for each activity assuming the following total estimated activity for the year: 45,000 hours preparation time, 45,000 cooking and draining hours, and 9,000,000 packages.

Correct Answer:

Verified

Allocation bases:

Preparation = $900,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Preparation = $900,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Use the information below to answer the

Q71: In ABC it is assumed that it

Q72: The Braveheart Corporation uses departmental overhead rates

Q74: Use the information below to answer the

Q76: Why are the benefits of adopting ABC/ABM

Q77: If a company's plantwide overhead rate is

Q78: All of the following are activities in

Q79: The benefits of using the ABC costing

Q80: Which of the following statements does NOT

Q83: If a company uses departmental overhead allocation