Multiple Choice

Use the information below to answer the following question(s) :

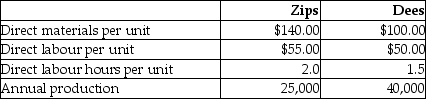

Kepple Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labour hours. Here is data related to the company's two products:

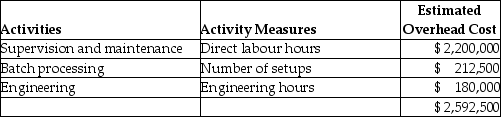

Information about the company's estimated manufacturing overhead for the year follows:

Information about the company's estimated manufacturing overhead for the year follows:

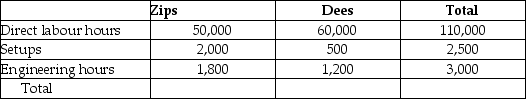

Additional information about production needed for the activity-based costing system follows:

Additional information about production needed for the activity-based costing system follows:

Expected Activity

-The amount of manufacturing overhead that would be allocated to one unit of Zips using an activity-based costing system would be closest to

A) $32.86.

B) $51.12.

C) $64.81.

D) $11.95.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Use the information below to answer the

Q71: In ABC it is assumed that it

Q72: The Braveheart Corporation uses departmental overhead rates

Q75: Clucker Chicken produces several styles of precooked

Q76: Why are the benefits of adopting ABC/ABM

Q77: If a company's plantwide overhead rate is

Q78: All of the following are activities in

Q79: The benefits of using the ABC costing

Q83: If a company uses departmental overhead allocation

Q108: Managers often reap benefits by using ABC