Multiple Choice

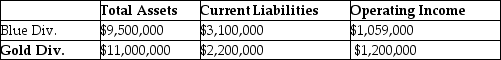

Springfield Corporation,whose tax rate is 30%,has two sources of funds: long-term debt with a market value of $8,400,000 and an interest rate of 8%,and equity capital with a market value of $14,000,000 and a cost of equity of 13%.Springfield has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

What is Economic Value Added (EVA®) for the Blue Division? (Round intermediary calculations to four decimal places. )

A) -$86,580

B) $86,580

C) $404,280

D) -$230,550

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The more owners have access to sensitive

Q13: The balanced scorecard in most organizations is

Q17: An example of a performance measure with

Q28: Care Inc. ,has two divisions that operate

Q31: Capital Investments has three divisions.Each division's required

Q34: The Cybertronics Corporation reported the following

Q36: Carriage Incorporated manufactures horse carriages.The company has

Q38: Companies are increasingly using nonfinancial measures to

Q67: Zenith Corporation's net income is $80,000. What

Q144: An excessive focus on diagnostic control systems