Multiple Choice

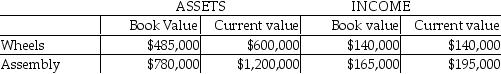

Carriage Incorporated manufactures horse carriages.The company has two divisions,Wheels and Assembly.Because of different accounting methods and inflation rates,the company is considering multiple evaluation measures.The following information is provided for 2018:

The company is currently using a 12% required rate of return.

What are Wheels's and Assembly's residual incomes based on book values,respectively?

A) $71,400;$81,800

B) $81,800;$71,400

C) $68,000;$51,000

D) $51,000;$68,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The objective of maximizing return on investment

Q13: The balanced scorecard in most organizations is

Q29: Return on investment, Residual income, or Economic

Q31: Capital Investments has three divisions.Each division's required

Q32: Springfield Corporation,whose tax rate is 30%,has two

Q34: The Cybertronics Corporation reported the following

Q38: Companies are increasingly using nonfinancial measures to

Q55: Which of the following is true of

Q67: Zenith Corporation's net income is $80,000. What

Q78: Stock options give executives the right to