Essay

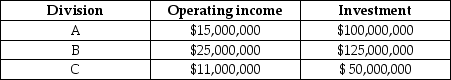

Capital Investments has three divisions.Each division's required rate of return is 15%.Planned operating results for 2015 are as follows:

The company is planning an expansion,which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a.Compute the current ROI for each division.

b.Compute the current residual income for each division.

c.Rank the divisions according to their current ROIs and residual incomes.

d.Determine the effects after adding the new project to each division's ROI and residual income.

e.Assuming the managers are evaluated on either ROI or residual income,which divisions are pleased with the expansion and which ones are unhappy?

Correct Answer:

Verified

_TB5540_00_TB5540_00

_TB5540_00_TB5540_00  _TB5540_0...

_TB5540_0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The more owners have access to sensitive

Q13: The balanced scorecard in most organizations is

Q17: An example of a performance measure with

Q28: Care Inc. ,has two divisions that operate

Q32: Springfield Corporation,whose tax rate is 30%,has two

Q34: The Cybertronics Corporation reported the following

Q36: Carriage Incorporated manufactures horse carriages.The company has

Q38: Companies are increasingly using nonfinancial measures to

Q104: The credit rating agencies require detailed disclosures

Q144: An excessive focus on diagnostic control systems