Multiple Choice

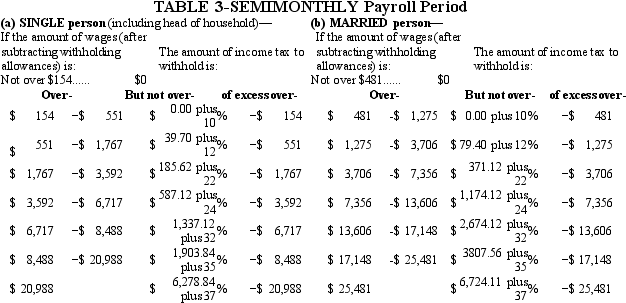

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

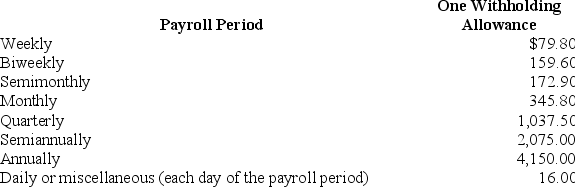

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A) $2,245.53

B) $2,403.95

C) $2,414.53

D) $2,178.90

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following federal withholding allowance

Q2: When a payroll check is subject to

Q3: Which of the following payment methods is

Q4: The percentage of the Medicare tax withholding

Q6: Jesse is a part-time nonexempt employee in

Q6: The use of paycards as a means

Q8: Post-Tax Deductions are amounts _.<br>A)That are voluntarily

Q9: Trish earned $1,734.90 during the most recent

Q10: Melody is a full-time employee in Sioux

Q11: Julian is a part-time nonexempt employee in