Multiple Choice

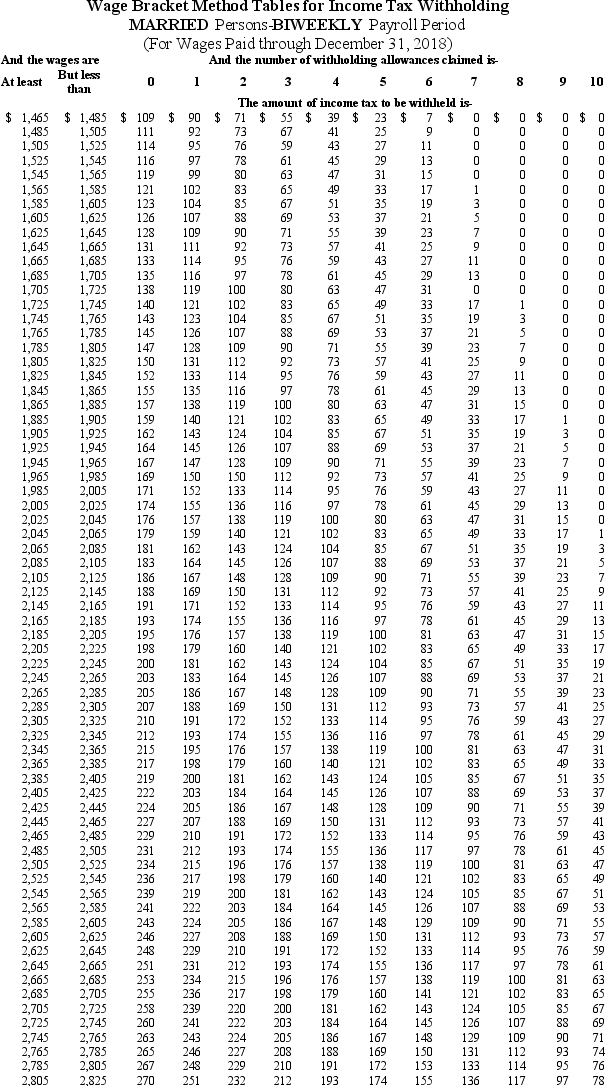

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

A) $239.25

B) $227.12

C) $265.47

D) $251.83

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Federal income tax, Medicare tax, and Social

Q60: The factors that determine an employee's federal

Q61: Why do employers use checks as an

Q62: From the employer's perspective,which of the following

Q63: Natalia is a full-time exempt employee who

Q64: Olga earned $1,558.00 during the most recent

Q65: Adam is a part-time employee who earned

Q66: Maile is a full-time exempt employee in

Q67: Andie earned $680.20 during the most recent

Q69: Which of the following is true about