Multiple Choice

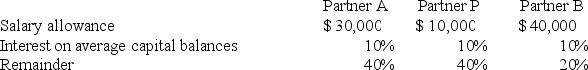

The APB partnership agreement specifies that partnership net income be allocated as follows:

Average capital balances for the current year were $50,000 for A,$30,000 for P,and $20,000 for B.

Average capital balances for the current year were $50,000 for A,$30,000 for P,and $20,000 for B.

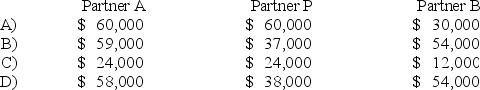

-Refer to the information given.Assuming a current year net income of $150,000,what amount should be allocated to each partner?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q11: Which of the following statements best describes

Q12: In the JK partnership,Jacob's capital is $140,000,and

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q14: The DEF partnership reported net income of

Q16: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q17: When the old partners receive a bonus

Q18: A joint venture may be organized as

Q19: RD formed a partnership on February 10,20X9.R

Q20: When a new partner is admitted into