Multiple Choice

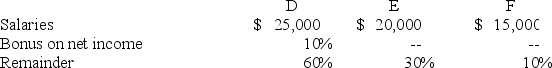

The DEF partnership reported net income of $130,000 for the year ended December 31,20X8.According to the partnership agreement,partnership profits and losses are to be distributed as follows:

How should partnership net income for 20X8 be allocated to D,E,and F?

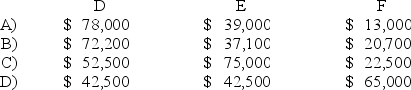

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The PQ partnership has the following plan

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q11: Which of the following statements best describes

Q12: In the JK partnership,Jacob's capital is $140,000,and

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q15: The APB partnership agreement specifies that partnership

Q16: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q17: When the old partners receive a bonus

Q18: A joint venture may be organized as

Q19: RD formed a partnership on February 10,20X9.R