Multiple Choice

In the JK partnership,Jacob's capital is $140,000,and Katy's is $40,000.They share income in a 3:2 ratio,respectively.They decide to admit Erin to the partnership.Each of the following questions is independent of the others.

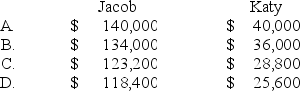

-Refer to the information provided above.Jacob and Katy agree that some of the inventory is obsolete.The inventory account is decreased before Erin is admitted.Erin invests $38,000 for a one-fifth interest.What are the capital balances of Jacob and Katy after Erin is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In the JK partnership,Jacob's capital is $140,000,and

Q2: The terms of a partnership agreement provide

Q3: When a new partner is admitted into

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q6: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A)I only<br>B)II

Q7: In the JK partnership,Jacob's capital is $140,000,and

Q8: When a partner retires from a partnership

Q9: The PQ partnership has the following plan

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q11: Which of the following statements best describes