Essay

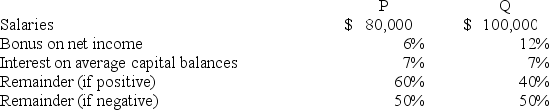

The PQ partnership has the following plan for the distribution of partnership net income (loss):

Required:

Calculate the distribution of partnership net income (loss)for each independent situation below (for each situation,assume the average capital balance of P is $140,000 and of Q is $240,000).

1.Partnership net income is $360,000.

2.Partnership net income is $240,000.

3.Partnership net loss is $40,000.

Correct Answer:

Verified

Situation 1: Net income is $36...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: In the JK partnership,Jacob's capital is $140,000,and

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q6: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A)I only<br>B)II

Q7: In the JK partnership,Jacob's capital is $140,000,and

Q8: When a partner retires from a partnership

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q11: Which of the following statements best describes

Q12: In the JK partnership,Jacob's capital is $140,000,and

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q14: The DEF partnership reported net income of