Multiple Choice

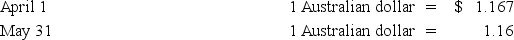

Robert Company sold inventory to an Australian company for 50,000 Australian dollars on April 1,20X0 with settlement to be in 60 days.On the same date,Robert entered into a 60-day forward contract to sell 50,000 Australian dollars at a forward rate of $1.164 in order to manage its exposed foreign currency receivable.The forward contract is not designated as a hedge.The spot rates were as follows:

-Based on the preceding information,had Robert not used the forward exchange contract,what would have been the foreign currency transaction gain or loss for the year?

A) Gain of $200

B) Gain of $150

C) Loss of $350

D) Loss of $200

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q51: On December 1,20X8,Hedge Company entered into a

Q52: Suppose the direct foreign exchange rates in

Q53: Levin company entered into a forward contract

Q54: An investor purchases a put option with

Q56: On December 1,20X8,Winston Corporation acquired 10 deep

Q57: On December 1,20X8,Winston Corporation acquired 10 deep

Q58: The fair market value of a near-month

Q59: On December 5,20X8,Texas based Imperial Corporation purchased

Q60: On December 1,20X8,Hedge Company entered into a