Multiple Choice

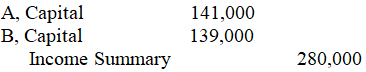

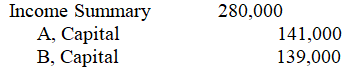

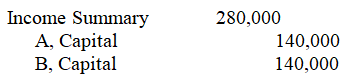

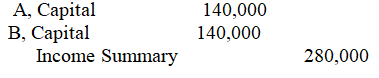

Partners A and B receive a salary of $16,000 and $14,000,respectively.They agree to share income equally.If the partnership has income of $280,000 in 20x5,the entry to close the income into their capital accounts is:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Under the partnership form of business,it may

Q86: As long as the action is within

Q90: Jordan,Kyle,and Noah have equities in a partnership

Q91: Income can be allocated to partners based

Q94: Jacob and Megan are partners who share

Q96: A liquidation differs from a dissolution in

Q98: Erin,Rachel,and Travis are partners in ERT Company,with

Q99: If the asset accounts did not reflect

Q103: When individuals invest property in a partnership,the

Q133: Austin invests $80,000 for a 20 percent