Essay

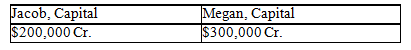

Jacob and Megan are partners who share profits in a ratio of 2:3,respectively,and have the following capital balances on September 30,20x5: The partners agree to admit Mitchell to the partnership.Calculate the capital balances of each partner after the admission of Mitchell,assuming that bonuses are recorded when appropriate for each of the following assumptions:

The partners agree to admit Mitchell to the partnership.Calculate the capital balances of each partner after the admission of Mitchell,assuming that bonuses are recorded when appropriate for each of the following assumptions:

a.Mitchell pays Jacob $100,000 for 40 percent of his interest

b.Mitchell invests $100,000 for a one-sixth interest in the partnership

c.Mitchell invests $100,000 for a 25 percent interest in the partnership

d.Mitchell invests $100,000 for a 15 percent interest in the partnership

Correct Answer:

Verified

Correct Answer:

Verified

Q86: As long as the action is within

Q90: Jordan,Kyle,and Noah have equities in a partnership

Q91: Income can be allocated to partners based

Q93: Partners A and B receive a salary

Q96: A liquidation differs from a dissolution in

Q98: Erin,Rachel,and Travis are partners in ERT Company,with

Q99: If the asset accounts did not reflect

Q99: If a partnership agreement does not specify

Q103: When individuals invest property in a partnership,the

Q133: Austin invests $80,000 for a 20 percent