Jordan,Kyle,and Noah Have Equities in a Partnership of $100,000,$160,000,and $140,000,respectively,and

Essay

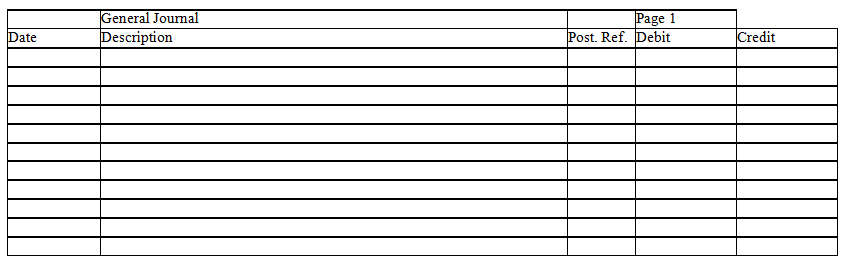

Jordan,Kyle,and Noah have equities in a partnership of $100,000,$160,000,and $140,000,respectively,and share income in a ratio of 5:3:2,respectively.The partners have agreed to admit Billy to the partnership.Prepare entries in journal form without explanations to record the admission of Billy to the partnership under each of the following assumptions:

a.Billy invests $80,000 for a 25 percent interest,and a bonus is recorded for Billy.

b.Billy invests $160,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Under the partnership form of business,it may

Q81: The admission of a partner does not

Q91: Income can be allocated to partners based

Q93: Partners A and B receive a salary

Q94: Jacob and Megan are partners who share

Q99: If the asset accounts did not reflect

Q101: Which of the following partnership characteristics is

Q103: When individuals invest property in a partnership,the

Q115: Joan contributes cash of $48,000,and Jamie contributes

Q133: Austin invests $80,000 for a 20 percent