Multiple Choice

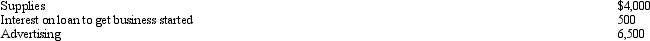

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income,deduct nothing for AGI,and claim $10,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Which of the following is not a

Q86: A political contribution to the Democratic Party

Q134: Woody owns a barber shop.The following selected

Q135: Distinguish between deductible bribes and nondeductible bribes.

Q136: Brenda invested in the following stocks and

Q137: Rex,a cash basis calendar year taxpayer,runs a

Q140: Theo owns a vacation home that is

Q141: Cory incurred and paid the following expenses:

Q142: None of the prepaid rent paid on

Q143: Which of the following is not relevant