Essay

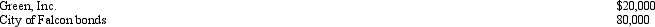

Brenda invested in the following stocks and bonds during 2010.

To finance the investments,she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2010 was $6,000.During 2010,Brenda received $2,400 of dividend income from Green,Inc.and $3,200 of interest income on the municipal bonds.

To finance the investments,she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2010 was $6,000.During 2010,Brenda received $2,400 of dividend income from Green,Inc.and $3,200 of interest income on the municipal bonds.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: A political contribution to the Democratic Party

Q131: Because Scott is three months delinquent on

Q132: A taxpayer pays his son's real estate

Q133: Gladys owns a retail hardware store in

Q134: Woody owns a barber shop.The following selected

Q135: Distinguish between deductible bribes and nondeductible bribes.

Q137: Rex,a cash basis calendar year taxpayer,runs a

Q139: Priscella pursued a hobby of making bedspreads

Q140: Theo owns a vacation home that is

Q141: Cory incurred and paid the following expenses: