Multiple Choice

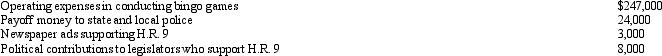

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2010,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2010,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: A political contribution to the Democratic Party

Q132: A taxpayer pays his son's real estate

Q133: Gladys owns a retail hardware store in

Q134: Woody owns a barber shop.The following selected

Q135: Distinguish between deductible bribes and nondeductible bribes.

Q136: Brenda invested in the following stocks and

Q139: Priscella pursued a hobby of making bedspreads

Q140: Theo owns a vacation home that is

Q141: Cory incurred and paid the following expenses:

Q142: None of the prepaid rent paid on