Essay

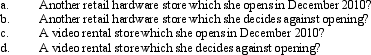

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2010 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2010 if the business is:

Correct Answer:

Verified

Correct Answer:

Verified

Q76: A baseball team that pays a star

Q86: A political contribution to the Democratic Party

Q125: Which of the following are deductions for

Q129: For purposes of the § 267 loss

Q131: Because Scott is three months delinquent on

Q132: A taxpayer pays his son's real estate

Q134: Woody owns a barber shop.The following selected

Q135: Distinguish between deductible bribes and nondeductible bribes.

Q136: Brenda invested in the following stocks and

Q137: Rex,a cash basis calendar year taxpayer,runs a