Multiple Choice

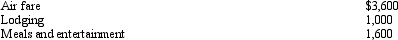

During the year,Oscar travels from Raleigh to Moscow (Russia) on business.His time was spent as follows: 2 days travel (one day each way) ,2 days business,and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement,Oscar's deductible expenses are:

Presuming no reimbursement,Oscar's deductible expenses are:

A) $1,800.

B) $3,000.

C) $4,200.

D) $5,400.

E) $6,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A participant who is at least age

Q47: Once set for a year, when might

Q70: After graduating from college with a degree

Q89: For tax purposes, travel is a broader

Q137: Amy works as an auditor for a

Q138: The total of traditional deductible,traditional nondeductible,and Roth

Q139: Donna,age 27 and unmarried,is an active participant

Q141: After the automatic mileage rate has been

Q145: An education expense deduction can be allowed

Q147: In the current year,Bo accepted employment with