Essay

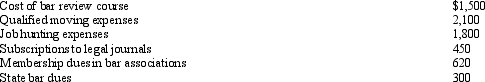

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Correct Answer:

Verified

$770.AGI is $30,000 [$32,100 (salary)- $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: A participant who is at least age

Q47: Once set for a year, when might

Q70: After graduating from college with a degree

Q89: For tax purposes, travel is a broader

Q141: After the automatic mileage rate has been

Q142: During the year,Oscar travels from Raleigh to

Q145: An education expense deduction can be allowed

Q148: For the current year,Horton was employed as

Q150: Merrill is a participant in a SIMPLE

Q159: A taxpayer takes six clients to an