Essay

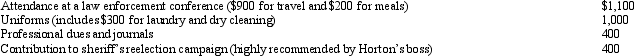

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

$1,400.$1,000 + $1,000 + $400 = $2,400 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: A participant who is at least age

Q47: Once set for a year, when might

Q70: After graduating from college with a degree

Q89: For tax purposes, travel is a broader

Q141: After the automatic mileage rate has been

Q142: During the year,Oscar travels from Raleigh to

Q145: An education expense deduction can be allowed

Q147: In the current year,Bo accepted employment with

Q150: Merrill is a participant in a SIMPLE

Q159: A taxpayer takes six clients to an