Multiple Choice

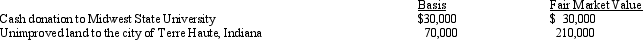

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in the current year:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the city of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the city of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

A) $84,000 if the reduced deduction election is not made.

B) $100,000 if the reduced deduction election is not made.

C) $165,000 if the reduced deduction election is not made.

D) $170,000 if the reduced deduction election is made.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Shirley pays FICA (employer's share)on the wages

Q79: John gave $1,000 to a family whose

Q81: Taxes assessed for local benefits, such as

Q81: Leona borrows $100,000 from First National Bank

Q89: Wendy,who is single,travels frequently on business.Brent,Wendy's 84-year-old

Q92: Joe and Nancy are married and file

Q93: The election to itemize is appropriate when

Q93: Frank, a widower, had a serious stroke

Q95: Terry pays $8,000 this year to become

Q96: In 2010,Michelle,single,paid $2,500 interest on a qualified