Multiple Choice

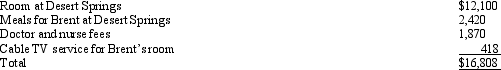

Wendy,who is single,travels frequently on business.Brent,Wendy's 84-year-old dependent grandfather,lived with Wendy until this year when he moved to Desert Springs Nursing Home because he needs daily medical and nursing care.During the year,Wendy made the following payments on behalf of Brent:  Desert Springs has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies for a medical expense deduction by Wendy?

Desert Springs has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies for a medical expense deduction by Wendy?

A) $1,870.

B) $13,970.

C) $16,390.

D) $16,808.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Mindy paid an appraiser to determine how

Q59: In applying the percentage limitations, carryovers of

Q79: John gave $1,000 to a family whose

Q81: Taxes assessed for local benefits, such as

Q84: George is single and has AGI of

Q87: Manny developed a severe heart condition,and his

Q88: Lonnie developed severe arthritis and was unable

Q92: Joe and Nancy are married and file

Q93: The election to itemize is appropriate when

Q94: Karen,a calendar year taxpayer,made the following donations