Essay

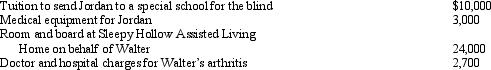

Joe and Nancy are married and file a joint return.They claim Nancy's father (Walter)and Nancy's son (Jordan)as dependents.During the current year,they pay the following expenses:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

a.Jordan?

b.Walter?

Correct Answer:

Verified

a.$13,000 ($10,000 + $3,000)fo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: John gave $1,000 to a family whose

Q81: Taxes assessed for local benefits, such as

Q81: Leona borrows $100,000 from First National Bank

Q87: Manny developed a severe heart condition,and his

Q88: Lonnie developed severe arthritis and was unable

Q89: Wendy,who is single,travels frequently on business.Brent,Wendy's 84-year-old

Q93: The election to itemize is appropriate when

Q94: Karen,a calendar year taxpayer,made the following donations

Q95: Terry pays $8,000 this year to become

Q96: In 2010,Michelle,single,paid $2,500 interest on a qualified