Essay

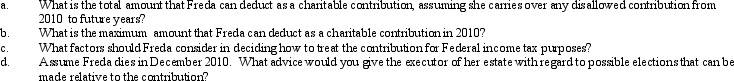

Freda,who has AGI of $100,000 in 2010,contributes stock in Tulip Corporation (a publicly traded corporation)to Central State University,a qualified charitable organization.The stock is worth $59,000,and Freda acquired it as an investment two years ago at a cost of $44,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Tony,a cash basis taxpayer,took out a 12-month

Q2: During the current year, Maria and her

Q3: Andrew was injured in an automobile accident

Q4: In 2010,Mary traveled 800 miles for specialized

Q5: Nancy had an accident while skiing on

Q6: Mel made the following donations to charity

Q7: Kelley,who has AGI of $250,000,owns stock in

Q9: A taxpayer pays points to obtain financing

Q11: On December 23,2010,Megan used her credit card

Q98: Fees for automobile inspections, automobile titles and