Essay

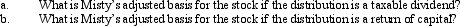

Misty owns stock in Violet,Inc. ,for which her adjusted basis is $75,000.She receives a cash distribution of $52,000 from Violet.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Annette purchased stock on March 1,2010,for $32,000.At

Q6: What effect do the assumption of liabilities

Q9: Ed and Cheryl have been married for

Q10: Inez's adjusted basis for 6,000 shares of

Q47: Define qualified small business stock under §

Q49: Under what circumstance is there recognition of

Q73: Why is it generally undesirable to pass

Q106: Explain how the sale of investment property

Q157: Discuss the treatment of losses from involuntary

Q217: Discuss the effect of a liability assumption