Essay

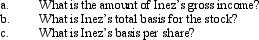

Inez's adjusted basis for 6,000 shares of Cardinal,Inc.common stock is $600,000.During the year,she receives a 5% stock dividend.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Misty owns stock in Violet,Inc. ,for which

Q6: What effect do the assumption of liabilities

Q6: Annette purchased stock on March 1,2010,for $32,000.At

Q9: Ed and Cheryl have been married for

Q12: Albert,age 57,leased a house for one year

Q13: Don,who is single,sells his personal residence on

Q14: What is the general formula for calculating

Q49: Under what circumstance is there recognition of

Q82: For gifts made after 1976, when will

Q217: Discuss the effect of a liability assumption