Essay

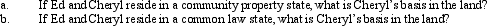

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $140,000.Ed dies in 2010,when the fair market value of the land is $220,000.Under the joint ownership arrangement,the land passed to Cheryl.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Misty owns stock in Violet,Inc. ,for which

Q6: What effect do the assumption of liabilities

Q6: Annette purchased stock on March 1,2010,for $32,000.At

Q10: Inez's adjusted basis for 6,000 shares of

Q12: Albert,age 57,leased a house for one year

Q13: Don,who is single,sells his personal residence on

Q14: What is the general formula for calculating

Q49: Under what circumstance is there recognition of

Q73: Why is it generally undesirable to pass

Q217: Discuss the effect of a liability assumption