Essay

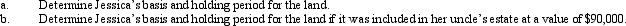

Jessica inherits land from her uncle.His adjusted basis in the land (purchased in November 2004)was $110,000 and it was included in his estate at a value of $225,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: a.Orange Corporation exchanges a warehouse located in

Q18: Samuel's hotel is condemned by the City

Q19: On January 5,2010,Bill sells his principal residence

Q20: Louis sold his farm during the current

Q21: Sam sells land with an adjusted basis

Q26: Louis owns a condominium in New Orleans

Q27: Walter acquired tax-exempt bonds for $330,000 in

Q67: If a taxpayer purchases taxable bonds at

Q117: Identify two tax planning techniques that can

Q146: Distinguish between a direct involuntary conversion and